02 February 2026

Make every payday count: transform children's lives through Payroll Giving

Payroll Giving is an easy and tax-efficient way of supporting the causes that matter to you

Share this page

Imagine helping a child discover the magic of reading every time you get paid. This February, during Payroll Giving Month, you can do exactly that while making your salary work harder for a cause you care about.

What is Payroll Giving?

Payroll Giving is an easy and tax-efficient way of supporting the causes that matter to you.

Payroll Giving is when you donate a portion of your salary each month to charity. Payroll Giving has a range of benefits for charities, employees and employers; we share some of these below, along with information on how you can support Chapter One this Payroll Giving Month and beyond.

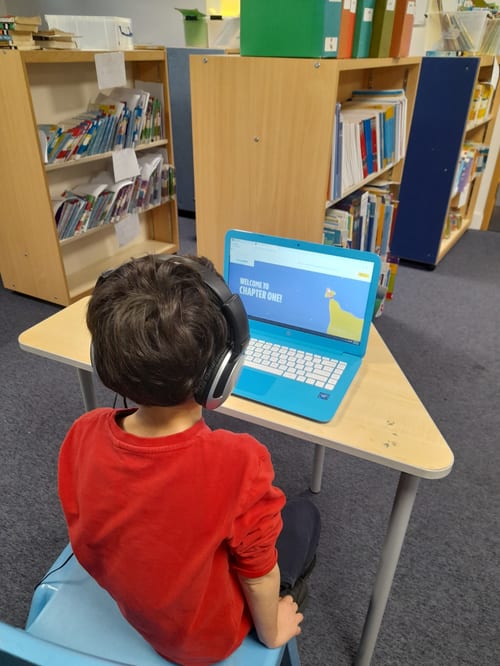

Developing vital reading skills so that children can thrive

Making a regular gift to Chapter One through Payroll Giving gives us a reliable source of income, allowing us to plan more effectively to meet the growing need for additional reading support for children facing disadvantage across the UK.

Ever since Chapter One…When we’re saying things on the board as a class, he’ll put his hand up always to read them, and even if it takes him a little longer to sound the words out, he’s been…a lot more confident and we can see that in class.

Ms Edwards, Noah’s teacher

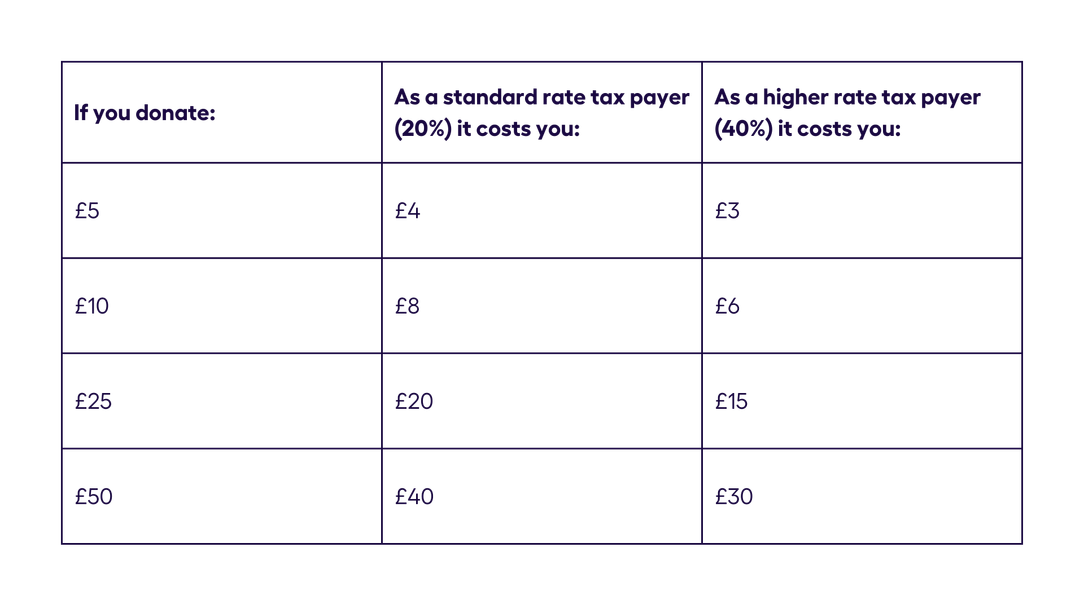

For employees, Payroll Giving is a really simple, flexible and tax-efficient way of donating to Chapter One. Donations come out of your gross salary, so if you donate £5 a month as a basic rate tax payer, you’ll only pay £4 and your donation will go even further to help children discover the joy of reading:

Ready to make payday more meaningful? Three simple steps to get started:

Payroll Giving is available to all salaried Pay As You Earn (PAYE) employees and is easy to set up:

Check your employer is signed up to a Payroll Giving Agency. For information on how to set up a scheme, visit GOV.UK.

Get in touch with your payroll department to register for Payroll Giving. No bank details are required.

Choose Chapter One (registered charity no. 1179625) to benefit from your support and decide how much you’d like to donate each payday. Payroll Giving is flexible, so you can change your donation amount at any time. Every donation helps to make a real difference to children’s reading abilities and enjoyment:

🌟 £5 could provide reading activity books for two children to enjoy.

🌟 £10 could provide an enhanced DBS check to one volunteer enabling them to read with a child for a year.

🌟 £20 could cover the full costs of providing one 1:1 online reading session for a child.

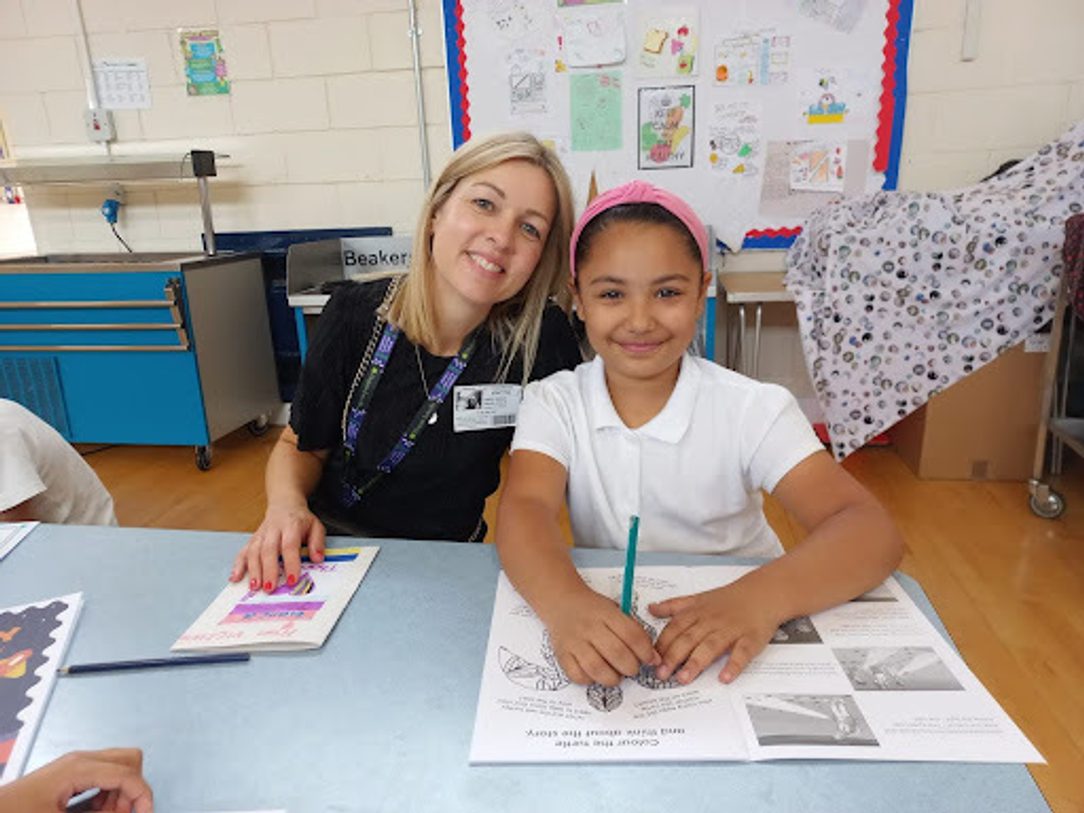

When I was in primary school, I really struggled with reading. When I read about Chapter One and how much it helps young children, I jumped at the opportunity to be involved in something that I know would have benefited me personally.

Chapter One reading volunteer

For employers, offering a Payroll Giving scheme has lots of benefits: it’s simple to set up; it enhances your corporate social responsibility profile and boosts your reputation amongst both existing and potential employees. You could also be awarded the government supported Payroll Giving Quality Mark.

Payroll Giving provides Chapter One with dependable monthly income that allows us to plan ahead and reach more children who need our support with reading. By signing up today, you'll not only make your salary work harder through tax-efficient giving, but you'll help us write countless new success stories as we match more volunteer readers with children who need them most.

Emma Bell, CEO, Chapter One

For further information please contact Lisa Barea, Trusts & Foundations Fundraiser, lisa.barea@chapterone.org

It all starts with literacy.